Thailand is a well-known retirement and expat destination for people all over the world. It’s vital to understand what kinds of income are subject to taxes in Thailand if you’re a foreigner residing there or if you have assets or connections there.

You have probably heard of several taxes that foreigners are subject to under Thai law from this brief summary of taxes.

Tax on Personal Income (“PIT”)

Thailand applies source rule and residence rule to levy Personal Income Tax (“PIT”) on international income.

Whether or not such money is paid in Thailand, foreigners who receive income that is originated from Thailand are liable to PIT under the source rule.

Depending on whether the foreigner is a tax resident of Thailand or not, the residence rule may or may not apply to income that is obtained abroad. The Thai tax year is based on the calendar year, and an expatriate is considered to be tax resident if they remain in Thailand for a total of 180 days or more during any given tax year. If a tax resident brings revenue into the Kingdom within the same tax year that it is earned, that resident’s income from foreign sources will be subject to PIT in Thailand. However, PIT does not apply to foreign-sourced income in Thailand if the foreign source is not a tax resident.

Progressive taxation applies to PIT, with rates ranging from 0% to 35% of net assessable income following the deduction of exempt income, costs, and allowances. Annual PIT returns (PND 90 or 91) are typically due by March 31 of the subsequent (tax) year. In the event that a foreign national receives specific income, like rental or company revenue, they must file a half-year PIT return (PND 94) by September 30 of the same tax year.

When becoming eligible to pay PIT, foreign nationals must apply for a tax identification number no later than sixty days from the date on which they start receiving taxable income.

Gift Tax

One specific kind of PIT to which the aforementioned source rule and/or residence rule also apply is the gift tax. In this scenario, a foreigner who receives moveable property (money, jewelry, automobiles, etc.) as a gift, sustenance, or support from a spouse, ancestor, or descendant will be liable to pay 5% gift tax on the amount that exceeds 20 million THB every tax year.

Nevertheless, the 5% Gift Tax will be applied to the share exceeding 10 million THB in each tax year if the moveable properties are given to the foreigner in the course of a formal ceremony, on customary occasions, or under moral obligation by a person who is not an ancestor, descendant, or spouse.

Last but not least, in every tax year, the 5% Gift Tax will be applied to the amount that exceeds 20 million THB of the assessed value of immovable assets (land, buildings, condominium units, etc.) for each legitimate child. These assets are transferred from parents to their legitimate children (but not adopted children) without any payment.

Withholding Tax (“WHT”)

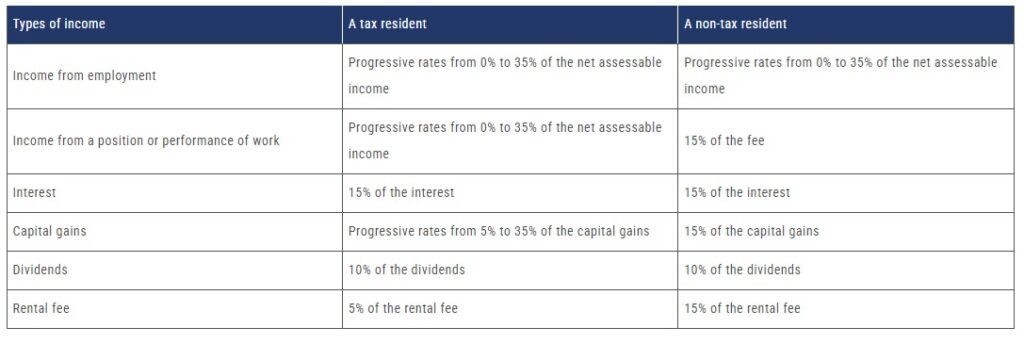

There are some income categories that are liable to Withholding Tax (“WHT”). When a payment is made, either a tax resident or a non-tax resident is obligated to have the WHT withheld. For example:

In the future, the WHT rate may also be lowered or eliminated if Thailand and the foreign national’s tax-residence country have a Double Taxation Agreement (“DTA”) in effect, or if other local laws, such as the Investment Promotion Act, apply.

Value Added Tax (“VAT”)

Value Added Tax (VAT) must be registered before company activities begin or within 30 days of earnings exceeding the threshold of assessable income for any foreigner who regularly sells goods or offers services in Thailand and whose annual revenues exceed 1.8 million THB.

It should be stressed that foreign nationals who offer electronic services (often known as “e-Services”) to non-VAT registered users in Thailand must register for VAT as well.

Certain activities, such as services provided in connection with an employment contract, the renting of real estate, and acting or performing as an actress, are, nevertheless, exempt from VAT.

The general VAT rate is now set at 7% of the value of the products or services. Exporting products and services is one of the activities that is exempt from VAT. Monthly VAT returns (P.P. 30 or P.P. 30.9) must be submitted by the fifteenth day of the following month, along with any overdue tax payments.

In Thailand, importers are liable for VAT regardless of whether they have registered for it or not. In this scenario, the Customs Department is responsible for collecting VAT at the time the items are cleared for import.

Specific Business Tax (or “SBT”)

Foreign nationals who transfer or sell real estate within five years of the acquisition date are liable to pay a Specific Business Tax (“SBT”) at the Land Office at a rate equal to 3.3% of the sale price or appraised value, whichever is higher. This tax includes a 10% local tax.

Stamp Duty (or “SD”)

Certain instruments require the execution of a Stamp Duty (“SD”), which, depending on the situation, can be applied or paid in cash at the Revenue Office or online through the Thai Revenue Department’s e-stamp duty system. These documents include agreements for the leasing of real estate or buildings, the transfer of shares, the transfer of immovable property, contracts for work, and loans of money, guarantees, powers of attorney, and duplicate copies of documents.

Depending on the transaction, the SD rate may be computed as a percentage of a certain value or it may be fixed. For example:

Throughout the term of the lease, the rental of land or building is subject to an SD of 0.1% of the key money, rental fee, or both; the transfer of shares is subject to an SD of 0.1% of the paid-up value of the shares or the share selling value, whichever is higher;

Hire of work contracts are subject to an SD of 0.1% of the compensation granted for the work under the contract; transfer of immovable property is subject to an SD of 0.5% of the assessed value or sale value, whichever is larger.

When duplicating an instrument, there is a standard deviation (SD) of 1.00 THB if the original instrument’s SD is less than 5.00 THB, or 5.00 THB if it exceeds 5.00 THB.

The lessor, share transferor, contractor, lender, seller of land or building, guarantor, etc. in the transaction are all accountable to pay or attach the SD. A beneficiary or the holder of a previously described legal instrument may also be required to pay SD in order for the document to be executed.

Specific Business Tax

Foreign nationals who is considered to be a Thai domicile under immigration law is required to pay inheritance tax along with the tax within 150 days of the day each testator’s net inheritance value surpasses 100 million THB. If the beneficiary is the testator’s ancestor or descendant, 5% of the net inheritance value—that is, the inheritance value left over after deducting any liabilities—above 100 million THB from each testator will be applied. In other circumstances, the net inheritance value exceeding 100 million THB is subject to a rate of 10%.

Other foreigners will also be subject to the aforementioned tax rates, but only if the inheritance is located, registered, withdrawn, or claimed in Thailand.

Stamp Duty

Any foreigner who owns land, a building or a condominium unit in Thailand is obligated to pay the Land and Building Tax (often known as the “L&B Tax”) by the end of April.

Presently, the land and building tax (L&B Tax) is computed using progressive rates that vary from 0.01% to 0.70% of the net appraised value of the land, building, and/or condominium unit. The calculation is dependent on the kind of use of the land and/or building, such as residential, retail, agricultural, or other uses.

Supreme Life capabilities

For both businesses and individuals, Supreme Life provides a broad range of services covering all business and industry-related taxes. These include tax planning, tax law, regulation, and double taxation treaty interpretation, tax assessment defense, Business leverage and Loans and tax claim litigation.